NCERT Solutions for Class 11th Business Studies Chapter 4 – Business Services

Multiple Choice Questions

1. DTH services are provided by .

(a) transport companies

(b) banks

(c) cellular companies

(d) None of these

Answer (c) DTH (Direct to Home) is a satellite based media service provided by cellular companies.

2. The benefits of public warehousing includes .

(a) control

(b) flexibility

(c) dealer relationship

(d) None of these

Answer (b) The benefits of public warehousing include flexibility in the number of locations, no fixed cost and value added services like packaging and labelling.

3. Which of the following is not a function of insurance?

(a) Risk sharing

(b) Assist in capital formation

(c) Lending of funds

(d) None of these

Answer (c) Functions of insurance include providing certainty, protection, risk sharing and assisting in capital formation.

4. Which of the following is not applicable in life insurance contract ?

(a) Conditional contract

(b) Unilateral contract

(c) Indemnity contract

(d) None of these

Answer (c) Life insurance contract is not a contract of indemnity as the lite of a human being cannot be compensated and only a specified sum of money is paid

5. CWC stands for .

(a) Central Water Commission

(b) Central Warehousing Commission

(c) Central Warehousing Corporation

(d) Central Water Corporation

Answer (c) A central government undertaking CWC i.e., Central Warehousing Corporation provides warehousing services for businessmen across the country.

Short Answer Type Questions

Question 1. Define services and goods.

Answer Services are essentially intangible activities which are separately identifiable and provide satisfaction of wants. We cannot kept it in stock. Their purchase does not result in the ownership of anything physical. Services involve an interaction to be realised between the service provider and the consumer.

A good is a physical product capable of being delivered to a purchaser and involves the transfer of ownership from seller to customer. Goods also refer to commodities or items of all types, except services, involved in trade or commerce.

Question 2. What is e-banking? What are the advantages of e-banking?

Answer The growth of internet and e-commerce is dramatically changing everyday, with the model world wide web and e-commerce the world is transforming inro a digital global village. In Simple terms, internet banking means any user with a PC and a browser can get connected to the banks website to perform the banking functions and avail the bank’s services.

e – banking refers to electronic banking or banking using electronic media. Thus, e-bankmq is a service provided by banks that enables a customer to conduct banking transactions, such as checking accounts, applying for loans or paying bills over the internet uSing a personal computer, mobile telephone or handheld computer.

e – banking includes a range of services like Electronic Funds Transfer (EFT), Automated Teller Machine (ATM), Electronic Data Interchange (EDI), Credit Cards, and Electronic or Digital Cash

Advantages of e-banking

(i) e-banking provides 24 hours, 365 days a year services to the customers of the bank,

(ii) It lowers the transaction cost.

(iii) It inculcates a sense of financial discipline and promotes transparency.

(iv) It reduces the load on bank branches.

Question 3. Write a note on various telecom services available for enhancing business.

Answer There are various type of telecom services which facilitate business. These Include

(i) Cellular Mobile Services These include all types of mobile telecom services including voice and non-voice messages, data services and PCO services utilising any type of network equipment within their service area.

(ii) Radio Paging Services Radio Paging Service is a means of transmitting information to persons even when they have mobile. It is an affordable one way information broadcasting solution which includes tone only, numeric only and alpha/numeric paging.

(iii) Fixed Line Services These include all types of fixed services including voice and non-voice messages and data services used to establish linkages for long distance traffic utilising any type of network equipment connected through fibre optic cables.

(iv) Cable Services These include linkages and switched services within a licensed area of operation to operate media services which are essentially one way entertainment related services.

(v) VSAT Services VSAT (Very Small Aperture Terminal) is a satellite-based communications service which is highly flexible, uninterrupted and reliable communication solution for applications such as newspapers-on-line and tele-education in both urban and rural areas.

(vi) DTH Services DTH (Direct to Home) is a satellite based media service provided by cellular companies. One can receive media services directly through a satellite with the help of a small dish antenna and a set top box.

Question 4. Explain briefly the principles of insurance with suitable examples.

Answer The specific principles of a valid insurance contract consist of the following

(i) Utmost Good Faith A contract of insurance is a contract of uberrimae fidei i.e., a contract found on utmost good faith. It is the duty of the insured to voluntarily make full, accurate disclosure of all facts, material to the risk being proposed and the insurer to make clear all the terms and conditions in the insurance contract. e.g., if any person has taken a life insurance policy by hiding the fact that he is a cancer patient and later on if he dies because of cancer then insurance company can refuse to pay the compensation as the fact was hidden by the insured.

(ii) Insurable Interest The insured must have an insurable interest in the subject matter of insurance. Insurable interest means some pecuniary interest in the subject matter of the insurance contract. The insured must have an interest in the preservation of the thing or life insured. e.q.; If a person has taken the loan against the security of a factory premises then the lender can take fire insurance policy of that factory without being the owner of the factory because he has financial interest in the factory premises.

(iii) Indemnity According to it the insurer undertakes to put the insured in the same position that he occupied immediately before the loss due to happening of the event insured against. The principle of indemnity is not applicable to life insurance e.g., A person insured a car for 2.5 lakh against damage or an accident case. Due to accident he suffered a loss of 1 5 lakh, then the insurance company will compensate him 1.5 lakh only not the policy amount i.e. 2.5 lakh as the purpose behind it is to compensate not to make profit.

(iv) Contribution Under this principle, an insurer who has paid a claim under insurance has the right to call upon other liable Insurers to contribute for the loss of payment. e.g . A person gets his house insured against fire tor e.g.,1 lakh with insurer A and for 50000 with insurer B A loss of 75000 occurred Then A is liable to pay 50000 and B is liable to pay 25000.

Question 5. Explain warehousing and its functions.

Answer Warehousing was initially viewed as a provision of static unit for keeping and storing goods in a SCientific and systematic manner so as to maintain their original quality, value and usefulness but now it is viewed as a logistical service provider of the right quantity, at the right place. in the right time. In the right physical form at the right cost

Functions of Warehousing

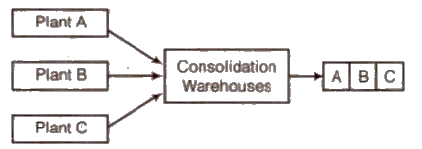

(i) Consolidation The warehouse receives and consolidates materials/goods from different production plants and dispatches the same to a particular customer on a Single transportation shipment

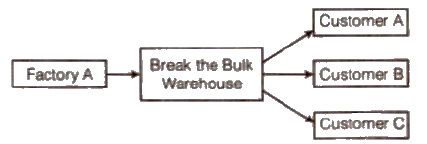

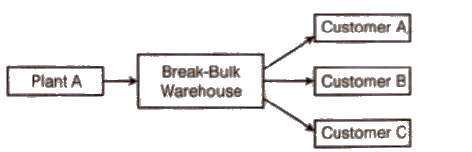

(ii) Break the Bulk The warehouse divides the bulk quantity of goods received from the production plants into smaller quantities and then transported according to the requirements of clients 10 their places of business.

(iii) StockPiling Goods or raw materials which are not required immediately for sale or manufacturing are stored in warehouses to be made available to business depending on customers demand. This type of warehouse is also known as the storehouse of surplus goods.

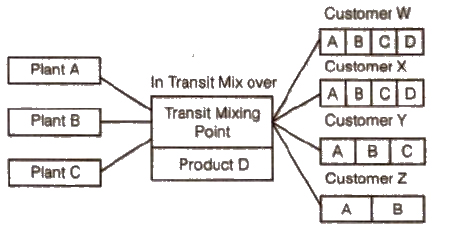

(iv) Value Added Services Provision of value added services such as in transit mixing, packaging and labelling is also a function of modern warehousing.

(v) Price Stabilisation Warehousing performs the function of stabilising prices by adjusting the supply of goods according to demand.

(vi) Financing Warehouse owners provide loans to the owners on security of goods and further supply goods on credit terms to customers. The warehouse keepers issue a receipt when goods are kept in warehouse. This receipt can be used as security to get loans from banks and owners In this way it also helps in financing

Long Answer Type Questions

Question 1. What are services? Explain their distinct characteristics?

Answer Services are essentially intangible activities which are separately identifiable and provide satisfaction of wants. Their purchase does not result in the ownership of anything physical. Services involve an interaction to be realised between the service provider and the consumer.

There are five distinct characteristics of services as discussed below

(i) Intangibility Services are intangible, i.e., they cannot be touched. They can only be experienced and hence the quality of the service cannot be determined before consumption Therefore, the service providers consciously work on creating a desired service so that the customer has a favourable experience. e.g, service in a restaurant should be a favourable experience for customer to visit again.

(ii) Inconsistency Services have to be performed exclusively each time according to different consumer demands as there is no standard tangible product on offer. Hence inconsistency is an important characteristic of services. Service providers need to modify their oHer to closely meet the requirements of the customers. e.g., services provided by nationalised banks are quite different from the banking services provided by private banks.

(iii) Inseparability Activities of production and consumption are performed simultaneously in case of services which makes the production and consumption of services seem to be inseparable as services have to be consumed as and when they are produced. e.g., we cannot separate the medical services provided by a doctor.

(iv) Absence of Inventory Services are intangible and perishable and hence cannot be stored for future use. This implies that the supply needs to be managed according to demand as the service has to be performed as and when the customer asks for it. e.g., a medicine can be stored but the medical care will be experienced only when the doctor provides It.

(v) Involvement Participation of the customer in the service delivery process is an Important characteristic of services as the customer has the opportunity to get the services modified according to his/her specific requirements e g., cinema halls are providing services to watch movie but the customer has to visit to the hall to experience the

movie in cinema hall.

Question 2. Explain the functions of Commercial Banks with an example of each.

Answer Banks perform a variety of functions including the basic or primary functions and the agency or general utility functions as discussed below

(i) Accepting Deposits Sanks accept deposits and pay interest on them as these deposits form the basis of loans given by banks. These deposits are generally taken through current account, savings account and fixed deposits Current account and savings accounts deposits can be Withdrawn at any time without any prior notice while Fixed reasons are time deposits of fixed maturity. Higher rate of interest is paid on fixed deposits as compared to the savings accounts.

(ii) Lending of Funds Second major function of commercial banks is to provide loans and advances to individuals and businesses out of the money received through deposits. These advances can be made in the form of overdrafts, cash credits, discounting trade bills, term loans, consumer credits and other miscellaneous advances.

(iii) Cheque Facility Banks collect the cheques of their customers drawn on other banks. The cheque is a developed credit instrument for the withdrawal of deposits which serves as a convenient and Inexpensive medium of exchange. There are two types of cheques mainly

(a) bearer cheques, which are encashable Immediately at bank counters

(b) crossed cheques which are to be deposited only in the payees account.

(iv) Remittance of Funds Commercial banks provide the facility of fund transfer from one place to another, on account of the interconnectivity of branches. The transfer of funds IS administered by using bank drafts, pay orders or mail transfers on which the bank charges a nominal commission. The bank issues a draft for the amount on its own branches at other places or other banks at those places. The payee can present the draft on the drawee bank at his place and collect the amount.

(v) Allied Services In addition to above functions, banks also provide allied services such as bill payments, locker facilities, underwriting services. Banks also perform other services like opening demat and trading accounts of customers for buying and selling of shares and debentures on instructions and other personal services like payment of insurance premium, collection of dividend etc.

Question 3. Write a detailed note on various facilities offered by Indian Postal Department.

Answer Indian post and telegraph department provides various postal services across India. For providing these services the whole country has been divided into 22 postal circles. These circles manage the functioning of the various head post offices, sub-post offices and branch post offices. There are 154149 post offices and 564701 letter boxes processing 1575 crore mails every year. The various facilities provided by postal department are broadly categorised into

(i) Financial Facilities Post Office Savings Bank is the largest retail bank having 150000 plus branches. Financial facilities are provided through the post office’s savings schemes like Public Provident Fund (PPF), Kisan Vikas Patra, and National Saving Certificates apart from retail banking functions of monthly income schemes, recurring deposits, savings account, time deposits and money order facility.

(ii) Mail Facilities Mail services consist of parcel facilities that is transmission of articles from one place to another; registration facility to provide security of the transmitted articles and insurance facility to provide insurance cover for all risks in the course of transmission by post.

(iii) Allied Facilities

(a) Greeting Post Indian post offers a beautiful and varied range of greeting cards for every occasion.

(b) Media Post Indian corporates can use media post which is an Innovative and effective vehicle to advertise their brand through postcards, envelopes, aerograms, telegrams, and also through letter boxes.

(c) Direct Post It is for direct advertising which can be both addressed as well as unaddressed.

(d) International Money Transfer Indian post has a collaboration with Western Union financial services, USA, which enables remittance of money from 185 countries to India.

(e) Passport Facilities Indian post has a unique partnership with the ministry of external affairs for facilitating the process of passport application.

(f) Speed Post Indian post has over 1000 destinations covered under the speed post facility ‘n India and links with 97 ma-v countries across the globe

(g) e-bill Post It is the latest offering of the Indian post and telegraph department to co’ eet b, payment across the counter for SSNL and Bharti Airtel.

Question 4. Describe various types of insurance and examine the nature of risks protected by each type of insurance.

Answer Insurance may be classified as follows

(i) Life Insurance A life Insurance policy protects against the uncertainty of life though Its scope has now Widened to suit the various insurance needs of an Individual Ike disab ty Insurance. health/medical insurance, annuity Insurance and life insurance proper,

Life Insurance may be defined as a contract In which the Insurer In consideration of a certain premium. agrees to pay to the assured, or to the person for whose benefit the policy is taken. the assured sum of money on the happening of a specified event contingent on the human life or at the expiry of certain period There are various types of life Insurance policies like

(a) Whole Life Policy

(b) Endowment life Assurance Policy

(c) Joint Life Policy

(d) Annuity Policy

(e) Children’s Endowment Policy

(ii) Fire Insurance Fife insurance Is a contract whereby the insurer, in consideration of the premium paid undertakes to make good any loss or damage caused by fire dUring a specified period upto the amount specified in the policy

The fire Insurance policy is generally taken for a period of one year after which it is to be renewed from time to lime. A claim for loss by fire is considered valid only if it satisfies the following two conditions

(a) There must be actual loss; and

(b) Fire must be accidents] and non intentional.

The fisk covered by a fire Insurance contract is the loss resulting from fire which is the proximate cause of the loss If damage is caused due to o overheating without ignition, it is not regarded as a fire loss within the meaning of fire Insurance and the loss cannot be claimed from the Insurer

(iii) Marine Insurance A marine insurance contract is an agreement whereby the insurer undertakes to Indemnify the insured In the manner and to the extent thereby agreed against manne losses. Marine insurance provides protection against loss by marine perils or perils of the sea There are three things involved in marine insurance

(a) Ship or Hull Insurance Since the ship is exposed to many dangers at sea, the Insurance policy is for Indemnifying the insured for losses caused by damage to the ship

(b) Cargo Insurance An insurance policy can be issued to cover against the risks to cargo while being transported by ship These risks may be at porl/.e . risk of theft. lost goods or on voyage etc.

(c) Freight Insurance Shipping company is insured under freight insurance for reimbursing the loss of freight to the shipping company If the cargo does not reach the destination due to damage or loss in transit.

Question 5. Explain in detail the warehousing services.

Answer Warehousing was Initially viewed as a provision of static unit for keeping and storing goods in a scientific and systematic manner so as to maintain their original quality. value and usefulness but now it is viewed as a logistical service that IS making available the right quantity, at the right place, in the right lime. In the right physical form at the right cost.

The various warehousing services are as follows

(i) Consolidation The warehouse receives and consolidates materials/goods from different production plants and dispatches the same to a particular customer on a single transportation shipment

(ii) Break the Bulk The warehouse divides the bulk quantity of goods received from the production plants Into smaller quantities to be transported according to the requirements of clients to their places of business.

(iii) StockPiling Goods or raw materials which are not required immediately for sale or manufacturing are stored in warehouses to be made available to business depending on customers demand. Agricultural products also need to be stored and released in lots as they are harvested at specific times in a year but are needed for consumption throughout the year.

(iv) Value Added Services Provision of value added services such as in transit mixing, packaging and labelling is also a function of modern warehousing Goods sometimes need to be opened and repackaged and labelled again at the time of inspection by prospective buyers. Another function Of modern warehouses is to grade goods according

to quantity and divide goods in smaller lots

(v) Price Stabilisation Warehousing performs the function of stabilising prices by adjusting the supply of goods according to demand. Thus, prices are controlled from falling when supply Is increasing and demand is slack and from rising in the reverse situation.

(vi) Financing Warehouse owners provide loans to the owners on security of goods and further supply goods on credit terms to customers.

Go Back to NCERT Solutions Maths Page Physics Biology Chemistry

To start your test

register with us:

To start

your test, registered user must login with their User Name & Password: